COVID-19 hit small businesses hard. With determination but little government help, three pulled through.

By Shanaé Harte

NABJ Monitor

Jessica Beltran and Jenny King started a business in Las Vegas in 2015 not to make big bucks or scratch an entrepreneurial itch. They did it to help get King’s husband out of prison.

King’s then-husband, who had served years in a Nevada prison, was looking for a way to earn an early release. He needed a job, and Beltran and King decided to create one for him.

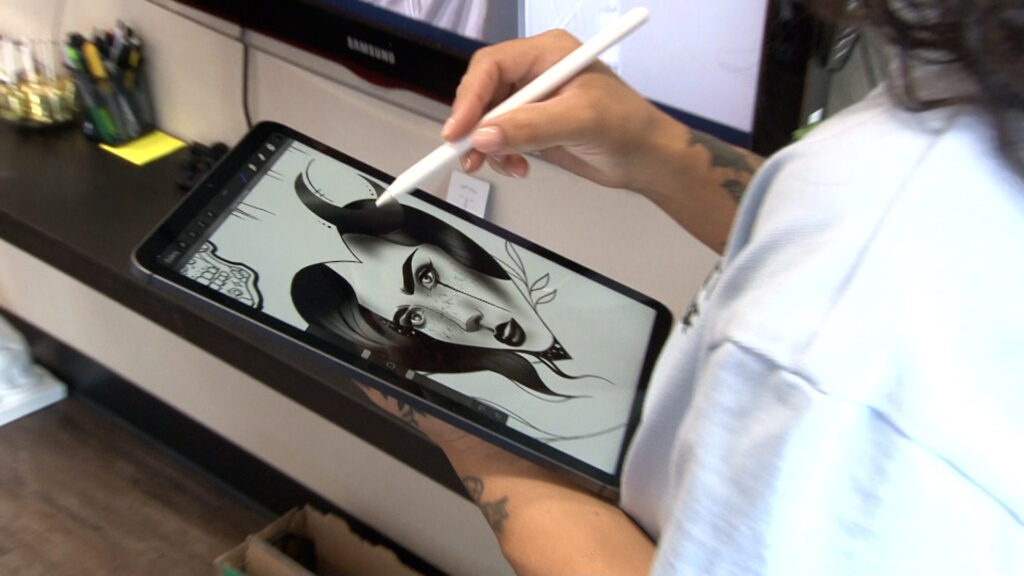

With a small artistic background, the pair opened Kingz Tattoo Parlor, where they could hire King’s partner. The marriage didn’t last, but the business did, even through a pandemic.

Kingz Tattoo Parlor is one of several Black-owned businesses in Las Vegas that struggled through the COVID-19 lockdown and emerged alive, if not necessarily thriving.

Black and Latinx businesses suffered more than small businesses as a whole during the lockdown that began in March 2020. University of California-Santa Cruz economist Robert Fairlee found that the number of Black business owners who were able to work fell 41% from February to April 2020, compared with an overall drop of 22%. It was 32% for Latinx business owners.

To combat the economic hit, the federal government created the Payroll Protection Plan and other programs through the Small Business Administration to help business owners make mortgage and/or rent, utility and payroll payments. But Black business owners had trouble accessing the funds.

“We didn’t get no help, no PPP help, no SBA help,” Beltran said. The sisters were told they weren’t eligible because everyone in the shop was an independent contractor.

“Sadly, a lot of people I knew got SBA help and PPP help, and they had businesses just like me,” she said. “So we were just like, why didn’t we get any help at all?”

Nikisha Pennie, the owner of HooHa V-Spa, also was shut out of government assistance. She had just started her spa, and businesses were expected to show proof of several months of revenue to qualify for aid. She did not have this proof and was not eligible.

Though Pennie understood this, she was taken aback when she realized that non-business owners were receiving help she couldn’t get.

“They gave people money that didn’t even have businesses, and it was hard for a small Black business to even get the funding,” she said. An Associated Press analysis found that minority-owned businesses were the last to be prioritized by PPP loan givers.

Beltran also experienced this but blamed the misallocation of funds on people who lied on their loan applications.

“So many people [scammed] the SBA, which is kind of like why we didn’t get money,” she said. “It left a lot of businesses without any help because there were people out there doing something wrong. It was very hard to even swallow that when I personally know people that didn’t have any businesses at all and they still got SBA loans.”

Beltran and her sister depleted their savings to get by. They were able to reopen the tattoo parlor months later but were still struggling financially and relocated to a less expensive suite to lower their costs.

Pennie was still working a full-time job when she opened her business. For six months, Pennie rented a salon suite for her spa but after a few months, she was able to secure her own space.

Because of her full-time position, Pennie didn’t face financial struggles, but she struggled in other ways. Pennie went into a state of depression from working full-time and supporting the business during the pandemic. It was overwhelming, she said.

“I just invested all of my money into this because I didn’t have loans and grants. I’m funding this by working a full-time job,” she said. “So, I’m trying to juggle all this and being a mom, being a business owner, being an employee with someone else.

“It was just like, Damn!” she said. “I kind of went into a kind of depressed state.”

John Pinnington, the owner of AA Printing Services, went through his struggles once non-essential businesses were required to close; printing was not considered essential.

“There was no business coming in, but the landlord still required you to pay rent, the machine rental companies still required you, everybody required you to keep paying, but you weren’t getting nothing coming in,” said Pinnington.

Pinnington was one of the few Black business owners who were able to secure a PPP and an Economic Injury Disaster Loan. He was able to keep up on his payments, and the governmental aid allowed Pinnington to pay his six employees until they were able to return to the store.

“I didn’t let them go because I had the PPP,” he said. “So, even when they weren’t here working and I would be working in the shop on my own, I would still write them a check at the end of the week to make sure they’re taken care of.”

The three businesses are back to normal now, but now they are facing a new challenge: inflation and the prospect of recession.

Pinnington created his business right after the 2010 recession, so he believes he is prepared to deal with another one.

“Some people are saying we’re in a recession already,” Pinnington said. “And this is a time now that I am using this moment either to make sure I have loans or lines of credit lined up for my companies because with a line of credit…it’s a safety net.

“So right now, if things were to slow down or we hit a recession, then I’d have to survive on that until the company comes back because this company will not stop.”

Pinnington is also working on securing permanent deals with high-class clients to ensure that he will always have business in case orders from average customers dry up during a recession.

Beltran is dreading a possible recession. She has already reluctantly raised her prices due to inflation. She had no choice, she said.

Pennie is holding firm to keep her prices the same, despite rising costs. The V-Spa owner fears that increasing her prices will drive customers away.

Beltran and Pennie don’t think there will be another lockdown, but if there is, they don’t expect to survive.

“If there was another pandemic, I would for sure close up,” Beltran said. “If it came down to the case where we had to come out of pocket like we did before, shutting down would be very necessary.”

These business owners are advising other Black business owners to be prepared for another shock. It’s important, they say, for Black-owned businesses to be prepared for any challenge.

“Prepare yourself,” Pennie said. “Prepare for this recession. I made it through the pandemic and I’m already putting it out there. We’re going to make it through this inflation.”

Be the first to comment